With the diversification of financial markets, investors are increasingly seeking efficient and flexible trading tools. The Contract for Difference (CFD) has emerged as a popular derivative in this environment. So, what is CFD?

This article explores its core concepts, mechanisms, advantages, risks, and practical strategies to help investors better understand and leverage this instrument for market positioning.

Basic Concepts and Mechanism of CFD

What is CFD?

A Contract for Difference (CFD) is a derivative financial instrument that allows investors to trade based on market price movements without directly owning the underlying asset.

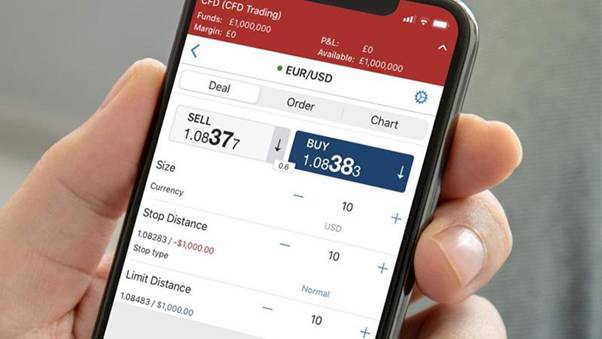

By paying a margin deposit, traders can use leverage to participate in both long and short positions. This means markets like equities, forex, gold, commodities, and cryptocurrencies can all be accessed via CFD platforms to capture profits from price volatility.

How CFD Trading Works

In CFD trading, both parties agree to settle based on the difference in asset prices. If you anticipate a market rise, you can go long; if you expect a decline, you can go short.

Unlike spot trading, CFDs involve no physical delivery of assets—only profit or loss settlements based on price movements. This flexibility allows traders to quickly adjust strategies in volatile markets for efficient capital utilization.

Advantages and Use Cases of CFD

Leverage: Amplify Market Exposure with Less Capital

A Contract for Difference (CFD) is a derivative financial instrument that allows investors to trade based on market price movements without directly owning the underlying asset. By paying a margin deposit, traders can use leverage to participate in both long and short positions.

This means markets like equities, forex, gold, commodities, and cryptocurrencies can all be accessed via CFD platforms to capture profits from price volatility.

Multi-Market and Multi-Asset Trading

CFDs provide access to multiple markets, including stocks, indices, forex, commodities, and cryptocurrencies. This cross-market flexibility enables traders to react quickly to global economic data, geopolitical events, or corporate earnings.

For instance, when a country announces strong economic growth, its related stock and currency CFDs often experience significant volatility, creating key short-term profit opportunities.

Fast Execution and Easy Market Access

CFD platforms often feature advanced software, such as the MetaTrader series, supporting real-time analytics, chart indicators, and automated trading strategies.

This allows traders to react swiftly to market changes, minimizing losses caused by delayed execution. In today’s fast-paced financial environment, quick market entry and exit capabilities are critical.

Risks and Considerations in CFD Trading

Leverage Risk: The Double-Edged Sword

While leverage can amplify gains, it can just as easily magnify losses. In unfavorable market movements, losses may exceed the initial margin, leading to margin calls or forced liquidation.

Therefore, strict risk management, prudent capital allocation, and well-placed stop-loss orders are essential for every CFD trader.

Market Volatility and Liquidity Risk

CFD trading relies heavily on the price movements of underlying assets. High volatility, low liquidity, or asymmetric information can all impact outcomes.

Traders should thoroughly study the characteristics of the underlying markets and closely monitor global economic trends and key indicators to adjust strategies in time.

The Importance of Choosing the Right Platform

Selecting a reputable broker is crucial for CFD trading. A quality broker offers not only a stable and secure platform but also transparent fees, professional support, and comprehensive market data.

Ultima Markets, as an industry-recognized broker, provides a diverse range of products, including CFDs, to meet the varied needs of traders in different market conditions.

How to Build Practical Strategies with CFDs

Analyze Market Trends to Spot Opportunities

A successful CFD strategy requires deep analysis of market trends. Traders can use technical tools like moving averages, RSI, and MACD to identify price movements and entry signals.

At the same time, fundamental analysis is equally important—monitoring economic data, central bank policies, and industry developments provides a holistic perspective for creating more robust trading plans.

Implement Risk Management Measures

Risk management is integral to strategy building. Traders should set margin levels and stop-loss limits based on their risk tolerance to avoid significant losses from short-term market swings.

Diversifying across multiple assets also helps mitigate risks associated with a single market.

Leverage Real-Time Data and Smart Trading

With advancements in technology, traders now have access to high-frequency algorithms and intelligent trading tools for automation.

Platforms like the MetaTrader series offered by Ultima Markets allow real-time data access and automated execution of pre-set strategies, helping traders stay competitive in rapidly changing markets.

Real-World Examples: Capturing Opportunities with CFDs

Example 1: CFDs in the Forex Market

Recently, as major central banks tightened monetary policies, the U.S. dollar strengthened, leading to significant adjustments in certain emerging market currencies.

Traders using forex CFDs identified the dollar’s upward trend through technical indicators, went long, and set strict stop-loss orders to control risk, ultimately achieving substantial short-term profits.

Example 2: Hedging in Commodities and Gold Markets

With rising geopolitical tensions, hedging sentiment grew in the markets. Traders turned to gold CFDs, leveraging technical indicators and market data to forecast upward price movements.

By adjusting positions strategically, they achieved both capital preservation and asset growth during market uncertainty.

Example 3: Agility in the Cryptocurrency Market

The cryptocurrency market often experiences sharp volatility due to regulatory changes and sentiment swings.

Using CFDs, traders anticipated short-term bitcoin price movements via technical analysis and adopted rapid entry-exit strategies to profit from fluctuations.

Effective risk management was crucial, enabling timely stop-loss actions to prevent significant losses.

Choosing the Right Broker: Advantages of Ultima Markets

Among numerous brokers, Ultima Markets stands out for its wide product offering, including CFDs, forex, cryptocurrencies, and more, alongside advanced platforms and professional risk management tools.

For traders seeking multi-market opportunities, its transparent environment, low fees, and 24/7 support are ideal for efficient trading.

With this platform, traders can:

- Access real-time market data and leverage advanced analytics to identify trading signals quickly.

- Automate strategies to minimize errors caused by emotional decisions.

- Receive comprehensive support, including market analysis and risk insights, for traders of all levels.

This seamless integration demonstrates Ultima Markets’ comprehensive capabilities while showing traders how to maintain an edge in dynamic markets.

If you are eager to get started, click here to register a trading account with Ultima Markets. Beginners are recommended to start with a demo account to experience a risk-free trading environment.

Once registered, you will gain access to a demo account where you can trade U.S. stocks, stock indices, gold, silver, more than 60 forex pairs, and cryptocurrencies such as Bitcoin.

The platform also provides market insights and real-time strategies to help you capture opportunities and practice fundamental analysis skills on stocks and financial reports.

Demo trading is an ideal way to start learning stock investment and helps you:

- Get familiar with platform operations and market trends.

- Test trading strategies without taking real market risks.

- Build confidence in a safe environment before moving into live trading.

Remember, in demo trading, consistent learning and rational decision-making matter more than chasing high returns.

Choosing the right platform and approach while improving your trading skills step by step is the key to long-term success in the forex market.

Conclusion: Navigate the Market and Use CFDs Wisely

In conclusion, CFDs are highly flexible tools that enable investors to participate in global price movements without owning the underlying asset.

Whether for short-term leveraged trades or long-term multi-asset strategies, CFDs offer a wide range of possibilities. However, traders must fully understand the risks of leverage and practice strict risk and capital management.

In a constantly changing market, acquiring the right knowledge and strategies is critical. With continuous learning, practical experience, and disciplined risk control, you can find your path to success in global financial markets.

FAQ:Common Questions About CFDs and Their Applications

Q:What is CFD, and how is it different from traditional stock trading?

A:A Contract for Difference (CFD) is a derivative instrument that allows traders to go long or short based on price movements without owning the asset. Compared to traditional stock trading, CFDs offer higher leverage and greater flexibility, but they also carry higher risk.

Q:How can I manage risk when trading CFDs?

A:Effective risk control includes setting strict stop-loss orders, using proper margin ratios, and diversifying across assets. Combining technical and fundamental analysis with automated tools on platforms like Ultima Markets enhances risk management.

Q:Which markets are suitable for CFD trading?

A:CFDs cover various markets, including forex, stocks, indices, commodities, and cryptocurrencies. This flexibility allows traders to diversify their positions, hedge risks, or seek arbitrage opportunities across markets.

Q:How do I choose a reliable CFD trading platform?

A:Key factors include product diversity, platform stability, transparent data, and professional support. Ultima Markets is highly regarded for offering diverse CFD products, advanced tools, and strong risk management, making it ideal for efficiency-focused traders.