In today’s fast-changing financial markets, choosing a reliable and secure trading platform is crucial for investors. This article focuses on “Ultima Markets review,” providing a comprehensive analysis from multiple perspectives including company background and regulatory status, fund security measures, technical stability, and trading conditions, helping you find the trading platform that best suits your needs.

Ultima Markets Platform Overview and Regulatory Status

1. Company Overview and Global Presence

According to the latest data, Ultima Markets belongs to the well-known Australian real estate company Viapac Group (Pan-Pacific Group) and specializes in Contract for Difference (CFD) trading. Since its establishment in 2016, the platform has set up physical offices in Australia, Cyprus, and Mauritius, holding local licenses and building a solid foundation for compliant operations.

Today, Ultima Markets serves over 172 countries and regions worldwide, offering more than 250 financial instruments, including forex, stocks, metals, energy, indices, and cryptocurrencies, meeting the diverse needs of different investors. This is one of the key factors many investors consider when searching for “Ultima Markets review.”

2. Fund Security and Trading Tools

To ensure client fund security, Ultima Markets has implemented the following measures:

- Segregated fund management: Client funds are held in the major Australian bank WESTPAC Bank, separate from company operating funds.

- Additional insurance coverage: The platform cooperates with the global insurance company Willis Tower Watsons to provide insurance coverage up to USD 1 million for each client.

At the same time, Ultima Markets offers a variety of trading tools and products for investors, with the main features as follows:

| Trading Platform | Product Types | Trading Conditions |

| MT4 (MetaTrader 4) | Forex, metals, indices, commodities, cryptocurrencies, stocks, and other CFD products | Minimum lot: 0.01, Maximum leverage: 1:2000 |

| Ultima Markets App | Same as above | Standard account spreads as low as 1.0, ECN account commission $5 per lot |

| WebTrader | Same as above | Supports deposit bonuses, EA automated trading, and demo accounts |

These measures and tools not only demonstrate the platform’s dedication to fund security and trading cost control but also further confirm the platform’s strength highlighted in “Ultima Markets review.”

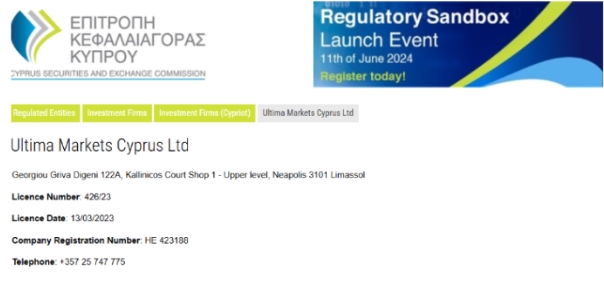

3. Strict Regulation and Legal Licenses

Regulatory licenses are an important criterion for evaluating a CFD platform. According to “Ultima Markets review,” the platform is legally regulated in multiple jurisdictions, ensuring professional and compliant operations.

The following table lists the main regulatory authorities and relevant information:

| Regulatory Authority | License Number | Company Name | Notes |

| Cyprus Securities and Exchange Commission (CySEC) | 426/23 | Ultima Markets Cyprus Ltd | Serves European clients, ensuring standardized service |

| Financial Sector Conduct Authority (FSCA) | FSP License No. 52497 | Ultima Markets (Pty) Ltd | Emphasizes regional market compliance, providing protection for South African investors |

| Australian Securities and Investments Commission (ASIC) | 001305972 | ULTIMA GROUP (AUS) PTY LTD | Australia’s authoritative regulator, enhancing operational transparency |

| Financial Services Commission (FSC) | GB 23201593 | Ultima Markets Ltd | Designed for the Asia-Pacific market (including Taiwan), supports trading strategies with up to 2000x leverage |

This multi-jurisdiction, multi-license operation fully reflects Ultima Markets’ compliant operations and strict regulation in the global market, providing investors with greater confidence.

Ultima Markets Cyprus CySEC License

Ultima Markets Safety and Technical Support

When choosing a trading platform, security and technical protection are always core concerns for investors. From the perspective of “Ultima Markets review” , the platform implements multiple measures in fund protection and technical security to ensure user funds and data safety while providing a stable and smooth trading experience.

Fund Security Measures

Strict Fund Segregation Mechanism

According to our in-depth analysis of “Ultima Markets 評價,” the platform performs exceptionally in fund management. First, Ultima Markets stores client funds in the well-known Australian bank WESTPAC Bank, completely segregating them from company operating funds. This fund segregation effectively reduces the risk of fund misappropriation and establishes a strong safety barrier for traders.

Multiple Regulatory Oversight and Additional Insurance

Additionally, Ultima Markets holds regulatory licenses in multiple jurisdictions, including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission of Mauritius (FSC). These strict regulatory requirements further enhance the platform’s operational transparency and legality.

Meanwhile, the platform partners with a globally recognized insurance company to provide customers with additional insurance coverage of up to $1,000,000. This measure is considered a key positive factor for fund security in “Ultima Markets Review.”

Additional Investor Protection Mechanism

Ultima Markets is also a formal member of the Financial Commission, meaning users can enjoy exclusive compensation fund protection in case of disputes. This fund becomes effective after a ruling by the Financial Commission, with a maximum compensation of up to €20,000. This additional protection enhances the platform’s credibility and is a highlight often noted in “Ultima Markets Review.”

Platform Technical Security

Advanced Security Protocols and Multi-layer Protection

In terms of technical security, Ultima Markets employs industry-leading security protocols to ensure comprehensive technical protection for the trading platform. The platform features multi-factor authentication and strong password policies to prevent unauthorized account access. Additionally, multi-layer firewalls and real-time monitoring technologies effectively counter DDoS attacks and other online threats, as fully reflected in “Ultima Markets Review.”

Anti-Money Laundering and Continuous Monitoring

To further reduce risks such as money laundering, Ultima Markets strictly complies with international anti-money laundering regulations and uses advanced transaction monitoring tools to detect suspicious activities in real time. The platform continuously tracks the latest technical vulnerabilities and threat trends, updating security protocols promptly to minimize potential risks, protecting traders’ information and funds.

Stability and Trading Speed Assurance

According to multiple data sources and user feedback, “Ultima Markets 評價” repeatedly highlights the platform’s outstanding performance in system stability and trading speed. Round-the-clock security monitoring and efficient server architecture ensure minimal execution delays, allowing investors to achieve timely and accurate trades in rapidly changing global markets. Third-party platforms report that 167 users rated the system stability and trading speed as AA, indicating excellent performance and reliability.

Trading Conditions and Tool Applications of Ultima Markets

When choosing a trading platform, trading conditions and tool applications are key factors for investors. According to the analysis of Ultima Markets 評價, the platform has competitive advantages in trading asset variety, trading costs, trading technology, and auxiliary tools, providing a flexible and convenient trading environment. The following section details its trading conditions and technology applications to help investors understand the platform’s practical performance.

Tradeable Asset Types

Ultima Markets offers over 250 financial products, covering forex, indices, stock CFDs, precious metals, commodities, and cryptocurrencies, catering to different traders’ needs.

Forex Trading

- Trades over 80 currency pairs, including major currencies (EUR/USD, GBP/USD, USD/JPY) and some exotic currencies.

- Maximum leverage 1:2000, allowing flexible fund use and enhanced trading efficiency.

- Low spreads and zero commission (standard trading account) are suitable for frequent traders and short-term trading strategies.

Index Trading

- Covers major global indices such as NASDAQ 100 (NAS100), Dow Jones Industrial Average (DJI30), and Germany DAX 30 (GER30).

- Maximum leverage 1:500, supporting both short-term and long-term trading strategies.

Stock CFD Trading

- Trades international well-known stocks such as Apple, Amazon, and Tesla.

- Leverage trading model improves capital efficiency, suitable for traders focused on individual stock movements.

Precious Metals and Commodities

- Gold (XAUUSD), Silver (XAGUSD), and commodities such as crude oil (WTI, Brent).

- High market liquidity, suitable for hedging trades and commodity market investors.

Cryptocurrency Trading

- Trades major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH).

- Deep liquidity pools combined with Equinix NY4 servers ensure low latency and fast execution.

Trading Platforms and Tool Applications

Ultima Markets provides multiple trading platforms and auxiliary tools suitable for various trading styles and investor needs.

MetaTrader 4(MT4)

MT4 is one of the world’s most popular forex and CFD trading platforms, fully supported by Ultima Markets.

Key Features:

- Powerful Technical Analysis: Built-in 30+ technical indicators, 9 timeframes, and multiple chart types.

- Automated Trading Support (EA): Allows users to write or use Expert Advisors (EA) to execute automated trading strategies.

- Multi-Device Compatibility: Offers desktop, WebTrader, and mobile apps for all types of traders.

- Risk Management Tools: Includes stop-loss, limit orders, and other risk controls to help investors reduce market risk.

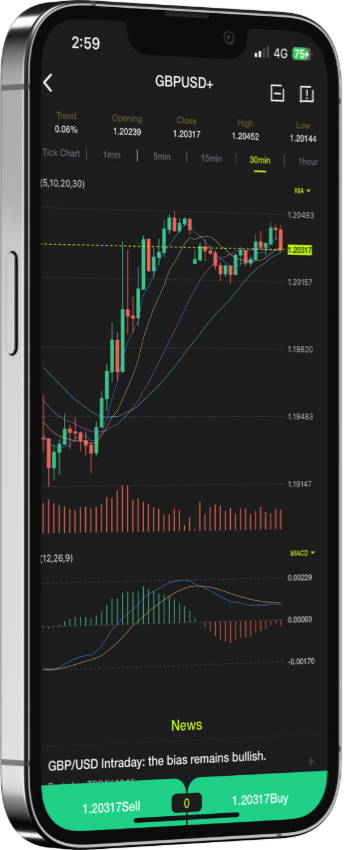

Ultima Markets Mobile Application

The proprietary mobile trading app provides an intuitive interface for mobile traders.

Key Advantages:

- Real-time market quotes and order execution for fast decision-making and short-term trading strategies.

- Built-in technical analysis tools, supporting trend lines, moving averages, RSI, and other indicators.

- Trade notifications and price alerts to track market changes and improve trading efficiency.

Trading Auxiliary Tools

In addition to trading platforms, Ultima Markets offers multiple practical tools to help optimize trading decisions.

- Economic Calendar: Tracks upcoming market data, central bank decisions, and economic events to help traders predict market fluctuations.

- Trading Calculator: Calculates pip values, spread costs, potential profits, and risks, suitable for risk management and trade planning.

- Market News and Analysis: Provides real-time market data to assist traders in understanding market trends.

Trading Conditions and Cost Analysis

Ultima Markets offers three main account types, each suitable for different trader needs.

| Account Type | Leverage | Spread | Commission | Minimum Deposit |

| Standard Account | 1:2000 | From 1.0 | $0 | $50 |

| ECN Account | 1:2000 | From 0.0 | $5/lot | $50 |

| Pro ECN Account | 1:2000 | From 0.0 | $3/lot | $20,000 |

Spreads and Fee Comparison (Popular Instruments)

| Instrument | Standard Account (Spread) | ECN Account (Spread) | Pro ECN Account (Spread) |

| EUR/USD | Avg. 1.3 | Avg. 0.1 | Avg. 0.1 |

| USD/JPY | Avg. 1.6 | Avg. 0.7 | Avg. 0.7 |

| AUD/USD | Avg. 1.7 | Avg. 0.6 | Avg. 0.6 |

| XAU/USD | Avg. 18.3 | Avg. 9.3 | Avg. 9.3 |

| BTC/USD | Avg. 995 | Avg. 395 | Avg. 395 |

Compared with other forex trading platforms, Ultima Markets ECN account commissions are only $5/lot, lower than the market average of $6–7. Combined with low spreads, ECN and Pro ECN accounts offer more competitive trading costs. For example, the EUR/USD trading cost in an ECN account (spread + commission) is approximately $7/lot, showing clear cost advantages.

Overall, according to Ultima Markets 評價, the platform demonstrates clear advantages in trading conditions and tool applications, including a wide variety of instruments, diverse trading platforms, low trading costs, and flexible leverage options. Whether for novice or professional traders, Ultima Markets provides an efficient, secure, and stable trading experience.

Deposits, Withdrawals, and Trading Rules of Ultima Markets

When choosing a trading platform, investors not only focus on trading conditions and tools but also highly value convenience, security, and transparency in deposits and withdrawals. Ultima Markets offers flexible payment methods and efficient processing, while imposing strict trading rules to maintain market fairness. The following section details the deposit/withdrawal procedures and trading regulations to help investors fully understand the platform’s fund management mechanism.

Ultima Markets Deposit and Withdrawal Methods and Processing Times

Ultima Markets supports multiple base currencies and offers deposits and withdrawals via wire transfer, credit card, e-wallet, and cryptocurrency (USDT), meeting the needs of different investors.

Deposit and Withdrawal Methods and Processing Times

| Payment Method | Minimum Deposit | Deposit Processing Time | Withdrawal Processing Time | Notes |

| Wire Transfer | $50 | 1–2 business days | 2–5 business days | Suitable for large transfers; banks may charge fees |

| Credit Card (Visa/Mastercard) | $50 | Within 1 hour | 2–5 business days | Some banks may have additional withdrawal restrictions |

| E-wallet (Skrill, Neteller, etc.) | $50 | 1–2 business days | 2-3 business days | Not supported in some countries; deposits do not qualify for bonus promotions |

| Cryptocurrency (USDT) | $50 | Within 1 hour | Up to 48 hours | Deposits not eligible for bonuses; consult customer service to confirm rules |

Ultima Markets performs well in deposit and withdrawal speed. Credit card and cryptocurrency deposits are fastest, completed within 1 hour, while cryptocurrency (USDT) withdrawals are most advantageous, with funds credited in as fast as 48 hours, greatly improving fund liquidity efficiency.

Deposit and Withdrawal Precautions

- E-wallet and cryptocurrency deposits are not eligible for bonuses. To participate in bonus promotions, use wire transfer or credit card deposits.

- Some banks impose credit card transaction restrictions, which may cause deposit or withdrawal failures; verify feasibility with the card issuer in advance.

- All withdrawals require identity verification. First-time withdrawals must complete the KYC (Know Your Customer) procedure for account security.

- Withdrawals must use the same payment method as deposits to comply with international financial regulations, prevent abnormal fund flows, and reduce money laundering risks.

Summary

In conclusion, Ultima Markets review presents an image of a trading platform with low trading costs, convenient operations, and strong market insight. However, there is still room for improvement in market expansion in certain regions and platform diversity. Investors should consider their own trading needs and risk preferences comprehensively to make the best choice for themselves.