In the world of investment and wealth management, whether you are a beginner just starting out or an experienced trader, a quality broker can be a reliable partner on your path to success. A broker is not just a simple trading platform, but also takes on multiple roles such as safeguarding funds, executing trades, providing market information, and offering professional training. This article will analyze the crucial role of brokers in investment, explore how to select the most suitable broker among numerous market participants, and illustrate with recent market trends and real data how brokers can help you secure a solid position in diversified asset allocation.

I. Basic Definition and Market Role of Brokers

1.1 Broker Positioning and Functions

Brokers act as a bridge connecting investors with financial markets. Their main functions include:

- Trade execution: Providing a platform for investors to buy and sell various financial products (such as forex, stocks, gold, contracts for difference, and cryptocurrencies), ensuring orders are executed quickly and accurately.

- Fund security protection: Ensuring safe custody of client funds through strict regulatory frameworks and risk control measures, reducing fraud and trading risks.

- Market information provision: Delivering real-time quotes, technical charts, economic calendars, and professional analysis to assist investors in making informed decisions.

- Education and training: Offering online seminars, demo accounts, and professional articles for investors at different levels, helping them progress from beginner to advanced.

II. Core Roles of Brokers in Investment

2.1 Providing an Efficient and Stable Trading Environment

2.1.1 Trade Execution and Liquidity

An efficient and stable trading environment ensures orders can be executed promptly, avoiding slippage caused by delays.

- Advanced technology support: Most modern brokers integrate advanced trading platforms such as the MetaTrader series, making technical analysis, order execution, and automated trading more convenient.

- Liquidity advantage: Quality brokers usually cooperate with multiple liquidity providers to ensure sufficient order books even during market volatility, thereby reducing trading costs.

For example, in the 2023 forex market, frequent global economic data releases caused sharp volatility, making it especially important to choose a platform with a high-speed trading system. Some brokers partnered with well-known liquidity providers to achieve millisecond-level order execution, earning unanimous praise from investors.

2.1.2 Stability and Security Protection

In the investment process, fund security remains one of the investors’ top concerns.

- Regulatory qualifications: Quality brokers hold licenses issued by financial regulators in different countries and undergo regular inspections.

- Segregated fund custody: Client funds are kept separate from company funds to ensure that client assets are not affected in the event of company financial issues.

- Information security: Advanced encryption technologies and data protection mechanisms effectively prevent client information leakage and cyberattacks.

2.2 Providing Professional Market Information and Trading Tools

2.2.1 Real-Time Quotes and Technical Analysis

An outstanding broker provides users with real-time market data and integrates comprehensive technical indicators and charting tools.

- Technical charts: Investors can use various technical indicators (such as RSI, MACD, Bollinger Bands) to capture market trends and develop more systematic trading strategies.

- Economic calendar: Tracking the release times of major global economic data allows investors to prepare in advance and reduce risks from sudden news.

- Professional analysis: Some brokers regularly publish market research reports and analysis articles, helping investors interpret trends from both macroeconomic and technical perspectives.

2.2.2 Trading Tools and Platform Integration

In today’s financial markets, many brokers have integrated copy trading, demo accounts, automated trading, and community interaction into their platforms, offering users a comprehensive trading experience.

- Copy trading function: Allows investors to easily replicate successful traders’ strategies, lowering entry barriers while learning advanced techniques.

- Demo account: Provides beginners with a risk-free practice environment, helping them gain experience before entering the real market.

- Automated trading: Through Expert Advisor (EA) strategies, investors can execute trades automatically based on preset rules, reducing the impact of emotional decisions.

For example, Ultima Markets excels in integrating the MetaTrader platform, offering both high-speed, stable order execution and features like copy trading and automated trading, ensuring that both professional traders and beginners enjoy a superior experience.

2.3 Education and Training: Supporting Investors’ Continuous Growth

2.3.1 Providing Diverse Learning Resources

For investors, learning is endless. Many brokers regularly host online seminars, live webinars, and strategy-sharing sessions. These activities not only help investors better understand how markets work but also keep them updated with the latest market trends and trading skills.

- Professional instructor guidance: By inviting experienced traders or analysts to share insights, learning content becomes more engaging and practical.

- Online resource library: Includes e-books, video tutorials, and technical articles, meeting the learning needs of investors at different levels.

- Practical case studies: Sharing real market cases and trading strategies helps investors gain valuable experience from both successes and failures.

2.3.2 Building an Investment Community

Quality brokers often build active investor communities through forums, social media, and instant messaging tools, enabling investors to exchange ideas, discuss, and support each other. Such interaction not only boosts investors’ confidence but also promotes collective improvement in trading skills, forming a virtuous cycle.

Ⅲ. How to Choose the Right Quality Broker for Yourself?

Choosing a broker is like choosing a business partner, requiring consideration of multiple factors. Here are several key indicators to help you make a wise decision:

3.1 Regulation and Qualification

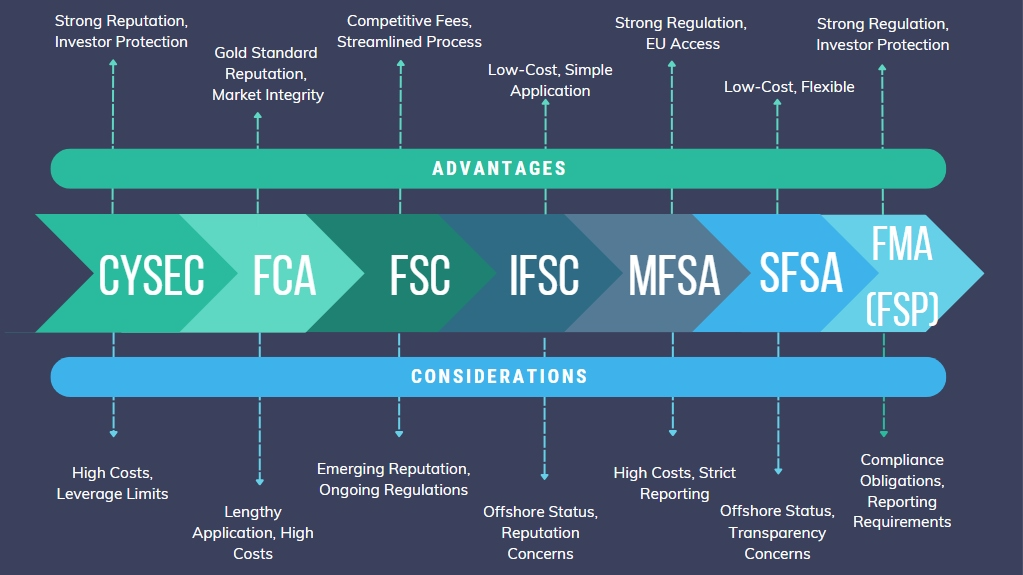

- Legal licenses: Quality brokers usually hold licenses from multiple regulatory authorities such as the UK FCA, Australia ASIC, and EU CySEC, which provide legal protection for investors.

- Transparent reporting: Regularly publishing financial conditions and client fund segregation reports to demonstrate the company’s transparency and integrity.

3.2 Trading Platform and Technical Support

- Platform stability: Whether it provides advanced trading systems (such as the MetaTrader series), low-latency execution speed, and an intuitive, user-friendly interface.

- Data and tools: Whether it offers real-time quotes, technical charts, economic calendars, and other professional tools to assist investors in developing trading strategies.

3.3 Services and Educational Resources

- Customer service: Whether it provides 24/7 customer support and multilingual services to ensure timely assistance when problems arise.

- Training resources: Whether it offers online courses, seminars, and demo accounts as diversified learning resources to help you enhance trading skills.

3.4 Fee Structure and Trading Costs

- Trading fees: Whether spreads, commissions, and other hidden charges are reasonable, as they directly affect investors’ actual returns.

- Fund withdrawal: Whether the withdrawal process is convenient and whether there are additional fees or restrictions, which is also a key factor when selecting a broker.

For example, Ultima Markets is widely favored by investors due to its stable trading platform, strict regulatory measures, and rich educational resources, making it one of the top choices for many Taiwanese investors when selecting a broker.

Ⅳ. How Do Brokers Help You Seize Market Opportunities in Diversified Asset Investments?

4.1 Asset Allocation and Risk Diversification

When facing global market uncertainties, diversified asset allocation becomes particularly important. Quality brokers can provide a wide range of trading instruments, such as forex, gold, stocks, ETFs, cryptocurrencies, and CFDs, enabling investors to diversify based on market conditions.

- Reducing single-market volatility risk: By allocating across multiple markets simultaneously, investors can diversify risks from sharp fluctuations in a single market.

- Flexible adjustment: As market conditions change, real-time data and professional insights provided by brokers can help investors promptly adjust asset allocation to reduce risks.

4.2 Innovative Trading Models and Tool Applications

Modern financial markets emphasize efficiency and intelligence, and quality brokers often take the lead in introducing innovative trading models:

- Copy trading: Allows investors to directly replicate the trades of successful traders, reducing decision-making difficulty and quickly capturing market opportunities.

- Automated trading and EA strategies: Investors can execute trades automatically based on preset rules, avoiding mistakes caused by emotional fluctuations.

- Demo trading: Through a risk-free demo account, investors can test strategies in advance, strengthening confidence and accuracy before live trading.

These innovative tools not only improve trading efficiency but also enable investors to react quickly in a rapidly changing market, ensuring that no investment opportunity is missed.

Ⅴ. Real Cases: How Brokers Help Investors Achieve Success

5.1 High-Frequency Trading in the Forex Market

In the forex market, price fluctuations often occur dramatically within seconds. An investor, by choosing a broker with clear liquidity advantages, utilized an advanced automated trading system on the MetaTrader platform to achieve millisecond-level order execution. This investor applied professional charting tools and real-time market data to design precise short-term trading strategies, ultimately securing stable profits across multiple market swings. This success case relied heavily on the broker’s dual guarantee of technology and fund security.

5.2 Diversified Asset Allocation and Risk Control

Another investor engaged in global equities, forex, and cryptocurrency markets. Thanks to the broker’s broad asset offerings and comprehensive risk control systems, he could dynamically adjust and diversify funds across markets. For example, during downturns in the stock market, he shifted to the relatively less volatile forex and gold markets. In the cryptocurrency market, he leveraged copy trading functions to replicate strategies from professional traders, effectively reducing risks. This case illustrates how a quality broker can provide comprehensive market support and risk prevention measures, making diversified asset allocation more flexible and secure.

Ⅵ. How Do Brokers Continuously Promote Investor Education and Community Interaction?

6.1 Establishing a Comprehensive Online Learning Platform

Many top brokers focus not only on trading technology but also on comprehensive investor education. Through live webinars, expert lectures, and demo trading platforms, beginner investors can start with the basics and gradually progress to complex technical analysis. These resources significantly lower entry barriers and effectively help investors remain calm and rational during market volatility.

6.2 Actively Building Investor Communities

Brokers often leverage social platforms and internal forums to provide investors with a community environment for sharing insights, strategies, and mutual support. This interaction model helps with:

- Experience sharing: Investors can learn trading techniques from different markets and levels through discussions and sharing.

- Real-time Q&A: Professional customer service and experienced traders within the community can provide instant answers, reducing blind spots.

- Strategy complementarity: By exchanging information from multiple sources, investors can continuously refine their strategies and maintain a competitive edge in changing markets.

Ⅶ. Choosing the Right Broker is a Key Step Toward Investment Success

Checking Regulatory Credentials

When selecting a broker, regulatory credentials should be the top consideration. Strictly regulated platforms can ensure the safety of your funds and compliance with standards, which is particularly important for beginners. It is recommended to prioritize brokers regulated by well-known authorities such as:

- UK Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Swiss Financial Market Supervisory Authority (FINMA)

Ultima Markets (UM) is a trading broker regulated by multiple authorities, including CySEC and ASIC, ensuring the safety of investors’ funds. In addition, all UM clients are covered by Willis Towers Watson (WTW), an insurance brokerage company established in 1828 with global services, offering insurance protection of up to USD 1 million per account.

Comparing Trading Costs

Trading costs directly affect your overall returns, especially in low-deposit trading where spreads and commissions matter more. Different brokers offer different account types with varied fee structures. For example, Ultima Markets’ Standard Account charges no commission and spreads start from 1 pip, suitable for small or low-frequency traders; while the ECN Account offers spreads starting from 0 pips, with only $3–$5 commission per lot, making it ideal for high-frequency traders. It is recommended to compare spreads and commissions based on your trading frequency and budget to select the most cost-effective option.

Testing Customer Service and Deposit/Withdrawal Speed

For beginners, quality customer service and smooth fund flow are essential. A platform offering 24/5 support can provide timely help when issues arise. Ultima Markets provides around-the-clock support, with instant deposits and withdrawals completed within 1–3 days, offering high efficiency. It is recommended to test the platform’s customer service responsiveness and withdrawal process by opening a demo account or making a small deposit before committing, ensuring reliability when it matters most.

Choosing Based on Your Own Needs

Ultimately, choosing a broker should be based on your personal situation, such as budget, trading style, and learning needs. If you have limited capital and want to get started quickly, Ultima Markets’ $50 low deposit requirement, leverage up to 1:2000, and rich educational resources can meet beginner needs well. Whether you pursue low costs or high efficiency, you should choose according to your specific goals.

FAQ

Q1: How do brokers ensure the safety of client funds?

A: Quality brokers usually hold licenses from multiple regulators and adopt segregated fund management to separate client funds from company funds. In addition, advanced information security technology and regular regulatory inspections effectively reduce the risk of fund misappropriation or cyberattacks.

Q2: How can I evaluate the stability of a broker’s trading platform?

A: You can assess by reviewing order execution speed, network latency, user feedback, and whether a demo account is available for testing. Additionally, the broker’s partnerships with reputable liquidity providers are important reference factors.

Q3: Besides trade execution, what value-added services can brokers offer?

A: Quality brokers often provide professional market analysis reports, technical charts, online training courses, investor communities, and copy trading services, helping investors enhance trading capabilities and risk management from multiple aspects.