Thinking about starting forex trading but worried about high capital requirements? Lowest deposit forex brokers let beginners start with just a few dollars, reducing risk and easing entry. This article explains what lowest deposit brokers are, why they suit beginners, and recommends reliable platforms for 2025. Deposit requirements range from $1 to $100, with educational resources and demo accounts to prepare you before live trading. Read on to discover how to start trading forex with minimal cost!

What is a Lowest Deposit Forex Broker?

A lowest deposit refers to the minimum amount required to open a forex trading account, usually ranging from $1 to $100. These brokers provide an entry opportunity for traders with limited budgets, allowing you to start trading without committing large sums. For those looking to test platform features or market conditions, it also offers a low-risk approach. In short, it acts like a small entry ticket, letting you explore real forex trading while controlling costs.

Why Choose Lowest Deposit Forex Brokers?

After understanding lowest deposit forex brokers, you may ask: why choose them? These platforms allow you to enter the market with small capital while offering real benefits, especially for beginners or traders with limited budgets. Here are some key advantages:

- Low Risk: Test the market with small capital; even losses won’t affect financial stability, making entry stress-free.

- Learning Opportunity: Beginners gain experience through real trading without worrying about major losses, learning efficiently as they trade.

- Flexibility: Whether you have $1 or $100, these brokers accommodate different budgets, offering greater trading freedom.

These features make low-deposit forex brokers an ideal starting point, helping you begin your trading journey easily without facing high entry barriers.

Recommended Lowest Deposit Forex Brokers for 2025

To help you find the best options, we compared well-known brokers, including OANDA, Exness, Ultima Markets, Vantage, and Plus500, focusing on spreads, minimum deposits, leverage, and more.

Here is a detailed comparison:

| Broker | Minimum Deposit | Spread | Leverage | Regulators |

| OANDA | $100 (adjusted by local agent policy) | 0.2~1.8 | Up to 1:50 | FCA、CFTC、ASIC、IIROC |

| Exness | Standard: $10 Pro: $200 (RAW spread + commission) Micro: $1 Special: Crypto deposits (USDT/BTC) $5, instant, no fee | 0~0.9 | Up to unlimited | CySEC、FSCA、FSA |

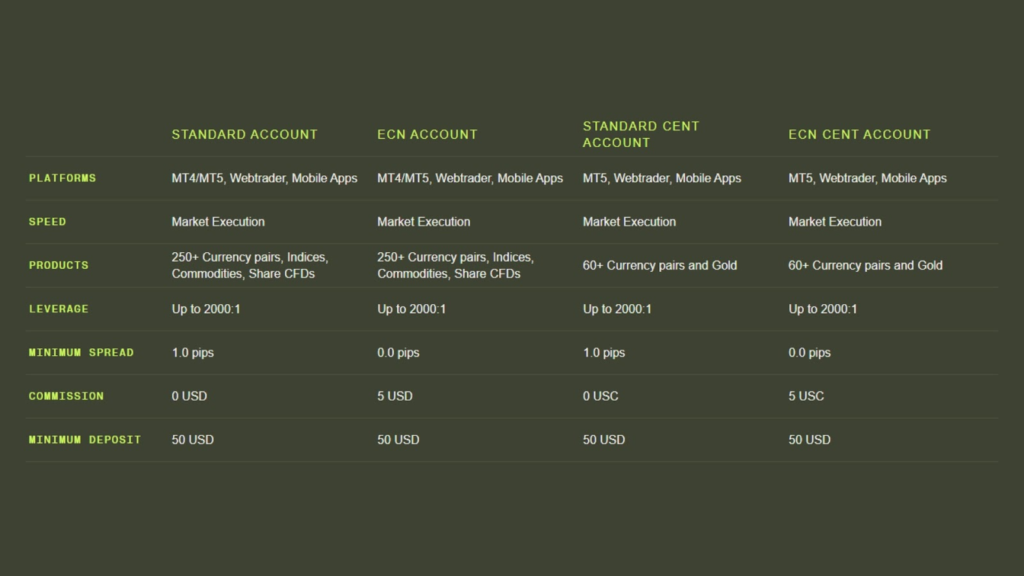

| Ultima Markets | Standard: $50ECN Pro: $200Micro: $10 (crypto deposits only) Special: First deposit ≥ $500 get 7-day zero spread trial | 0~1.8 | Up to 1:2000 | CySEC、ASIC、FSC Mauritius、FSCA |

| Vantage | Standard: $200ECN: $2,000Micro: $50 (0.01 lots only)Special: Crypto deposits (USDT/ETH) ≥ $100, instant, no fee | 0~1.5 | Up to 1:1000 | FCA、ASIC、VFSC、FSCA |

| Plus500 | Retail: $200 (SCB-regulated, Asia/Africa)Professional: €10,000 (verified net assets ≥ €500k) | 0.8~5 | Up to 1:300 | FCA、ASIC、CySEC、SCB |

As shown above, Ultima Markets offers flexible and competitive trading conditions suitable for traders of different experience levels. The standard account has a minimum deposit of $50, while the ECN Pro account requires $200, making it ideal for budget-conscious investors. ECN account spreads start from 0, with $10 round-turn commission per lot, offering transparent and attractive costs for active traders. The platform provides leverage up to 1:2000, exceeding industry norms, allowing traders to amplify market exposure while emphasizing proper risk management.

Regulatory-wise, Ultima Markets is supervised by CySEC and ASIC, ensuring fund security and trading transparency, enhancing user confidence. Additionally, traders depositing $500 or more for the first time receive a 7-day zero spread trial, ideal for beginners to familiarize themselves with the platform in a low-cost environment. Overall, Ultima Markets combines low deposit requirements, attractive spreads and commissions, high leverage options, and strict regulation to provide a reliable and efficient trading environment, especially for traders seeking cost optimization and flexibility.

How to Choose the Right Low Deposit Broker for You

In the “2025 Recommended Lowest Deposit Forex Brokers,” we introduced several reliable low deposit platforms, such as Ultima Markets and Vantage. After reviewing these options, you may wonder: how do you select the broker that best fits you? Everyone’s trading goals, budget, and needs differ, so here are practical tips to make an informed choice.

Check Regulatory Credentials

Regulation is the primary consideration when choosing a broker. Strictly regulated platforms ensure fund security and compliance, especially important for beginners. Prioritize brokers supervised by reputable authorities such as:

- FCA (UK Financial Conduct Authority)

- ASIC (Australian Securities and Investments Commission)

- CySEC (Cyprus Securities and Exchange Commission)

- FINMA (Swiss Financial Market Supervisory Authority)

As mentioned, Ultima Markets is regulated by CySEC and ASIC, providing multiple layers of fund protection to boost trading confidence.

Compare Trading Costs

Trading costs directly affect overall profits, especially in low deposit trading where spreads and fees matter more. Different brokers offer various account types with different cost structures. For example, Ultima Markets’ standard account has zero commission with spreads from 1 pip, suitable for small or low-frequency traders, while the ECN account offers spreads from 0 pip with $3–$5 commission per lot, ideal for high-frequency traders. Compare spreads and fees according to your trading frequency and budget to choose the most cost-effective option.

Test Customer Service and Deposit/Withdrawal Speed

For beginners, quality customer service and smooth fund transfers are essential. A platform offering 24/5 support can assist immediately when issues arise. Ultima Markets provides round-the-clock support; deposits are instant, and withdrawals typically complete within 1–3 days. It is recommended to test the platform via a demo account or small deposit to evaluate customer response and withdrawal procedures, ensuring reliability when needed.

Choose Based on Your Needs

Ultimately, broker selection should be based on your personal situation, such as budget, trading style, and learning needs. If your capital is limited and you want to start quickly, Ultima Markets’ $50 minimum deposit, up to 1:2000 leverage, and rich educational resources can meet beginners’ requirements. Whether you seek low cost or high efficiency, tailor your choice to your goals.

Beginner’s Guide: Simple Steps to Start Trading

To start forex trading, open an account with a forex broker. Using Ultima Markets as an example, here’s a simple process from account registration to trading, helping investors enter the market quickly while improving efficiency and risk management.

- Account Registration

First, visit the Ultima Markets website or download the official app, and follow system instructions to fill in personal and identity verification information. The entire registration process takes only a few minutes. - Deposit Funds

After registration, deposit funds. Ultima Markets supports credit/debit cards, bank transfers, e-wallets, and cryptocurrencies. The minimum deposit is $50, allowing flexible and convenient fund access to start trading quickly. - Choose Trading Products

Once on the platform, you can browse various tradable assets. Ultima Markets offers abundant forex pairs, as well as precious metals, indices, and commodities, catering to diverse strategies and risk preferences. - Place Orders

After selecting your trading instrument, set the lot size, choose suitable leverage (Ultima Markets offers up to 2000x, but select according to your risk tolerance), set take profit and stop loss, then click “Buy” or “Sell.” The intuitive order process allows quick execution. - Monitor and Close Trades

After executing trades, monitor market movements and positions in real time via the Ultima Markets platform. When prices reach your target, manually close or set automatic closure to lock in profits or limit losses.

If you’re not ready to trade with real funds, demo trading is an excellent option. Ultima Markets offers a demo account simulating real market conditions, allowing you to:

- Familiarize yourself with the forex platform’s operations;

- Test your trading strategies and adjust plans;

- Build confidence in a safe environment, preparing for live trading.

Through demo trading, you can understand market patterns, enhance sensitivity to market fluctuations, and lay a solid foundation for future live trading.