Why Choose an Online Trading Platform?

With technological advancements, online trading platforms have become essential tools for modern investors. In 2025, global financial markets face multiple challenges and opportunities. Suppose the U.S. Federal Reserve adjusts interest rate policies due to inflation pressures, causing increased USD volatility against other currencies; and the cryptocurrency market fluctuates amid regulatory changes. For investors, an efficient online trading platform not only provides instant market access but also helps them respond flexibly to these changes. For example, if geopolitical tensions in the Middle East push oil prices to $90 per barrel and gold exceeds $2,300 per ounce in early 2025, investors with a high-quality platform can quickly seize short-term opportunities.

The value of online trading platforms lies in bringing professional tools into everyday life, enabling beginners to start with small capital and allowing advanced investors to achieve multi-asset allocation. Whether you aim to profit from forex fluctuations or hold Taiwan Semiconductor (TSMC) stocks long-term, a platform that is powerful, cost-transparent, and secure can enhance your investment efficiency. This article will analyze top online trading platforms, helping you find the best choice in 2025 to start your wealth growth journey.

1. What Is an Ideal Online Trading Platform?

An ideal online trading platform must meet multiple requirements to suit the objectives of different investors. The detailed criteria are as follows:

- Diverse Asset Support: Markets change rapidly, and investors need to switch assets according to trends. For example, if gold rises due to safe-haven demand, you may shift to gold trading. A platform covering forex, stocks, commodities, CFDs, and cryptocurrencies allows you to adjust strategies anytime.

- Low-Cost Trading: Spreads and commissions directly affect returns. For example, in forex, if the EUR/USD spread decreases from 1 pip to 0.1 pip, transaction costs are significantly reduced, especially suitable for high-frequency traders and beginners.

- User Experience: An intuitive interface and a stable system are crucial. During U.S. earnings season, an efficient platform ensures smooth trade execution, preventing missed opportunities due to delays.

- Educational Resources: Market analysis, tutorials, and demo accounts can shorten the learning curve. For example, when USD/JPY fluctuates due to economic data, real-time insights can help you assess trends.

- Security: Platforms regulated by international authorities (such as FCA, ASIC, SEC) reduce capital risk and ensure smooth withdrawals.

In 2025 market, investors may pay more attention to platform flexibility and localized support, such as Traditional Chinese interfaces and fast customer service. Next, we introduce five top platforms to help you find the best online trading platform.

2. Recommended Best Online Trading Platforms

1. InteractiveBrokers

InteractiveBrokers, founded in 1978, is a U.S.-based online broker known for low costs and broad market coverage, serving investors worldwide. It is suitable for high-frequency traders and large capital users.

| item | content |

| Business | Stocks, futures, forex, bonds, ETFs, options; covering 150+ markets (US, Hong Kong, Taiwan, etc.) |

| Model | Broker model, direct access to global exchanges |

| Regulation | U.S. SEC, FINRA, UK FCA |

| Spreads & Commissions | Forex spreads from 0.1 pip, stocks $0.005 per share (minimum $1) |

| Pros | Low cost, wide market access, professional tools (IBKR Trader Workstation) |

| Cons | Complex interface, not beginner-friendly, minimum deposit $1,000 |

Use Case: If you anticipate TSMC growth due to AI chip demand in 2025, this platform allows low-cost trading of its U.S. ADR (TSM).

2. eToro

eToro, founded in 2007 and headquartered in Israel, is known for social trading, with over 30 million users worldwide. It is popular among younger investors and suitable for beginners to start quickly.

| item | content |

| Business | Stocks, ETFs, forex, commodities, cryptocurrencies |

| Model | Social trading model, supports copy trading |

| Regulation | UK FCA, Australia ASIC, Cyprus CySEC |

| Spreads & Commissions | Stocks/ETFs zero commission, forex spreads from 1 pip, crypto 0.75%-2% |

| Pros | Easy to use, strong social features, low minimum deposit ($50) |

| Cons | Limited advanced tools, higher spreads, $5 withdrawal fee |

Use Case: If interested in Bitcoin trends in 2025, you can follow professional investors via copy trading.

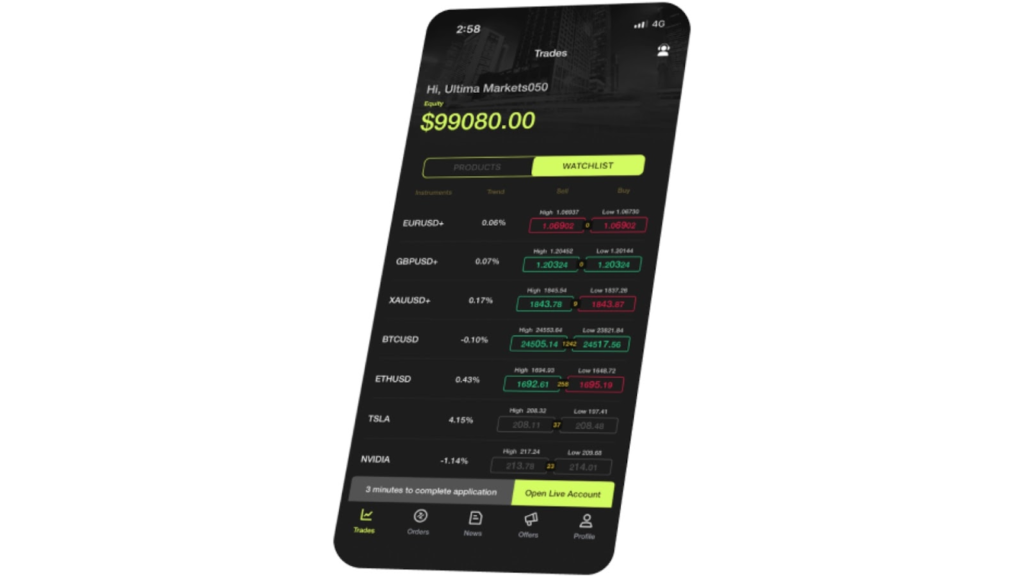

3. Ultima Markets

Ultima Markets is an emerging international broker focusing on forex and CFD trading, rapidly expanding in the Asia-Pacific region, suitable for small to medium investors.

| item | content |

| Business | Forex, precious metals, energy, indices, stock CFDs; supports MetaTrader 4/5 |

| Model | Broker model, emphasizes low spreads and leverage |

| Regulation | Mauritius FSC |

| Spreads & Commissions | Forex spreads from 0.1 pip, CFDs with no fixed commission |

| Pros | Low cost, free educational resources, stable MetaTrader platform |

| Cons | Limited product range, brand recognition needs improvement |

Use Case: If gold exceeds $2,300 per ounce in 2025 due to geopolitical tensions, you can efficiently participate in gold CFD trading.

4. Binance

Binance was established in 2017 and is headquartered in Malta. It is the world’s largest cryptocurrency platform by daily trading volume, suitable for crypto enthusiasts.

| Item | Content |

| Business | Cryptocurrency spot, futures, staking, NFTs, 350+ coins |

| Model | Exchange model, high liquidity |

| Regulation | Registered in multiple countries including Australia AUSTRAC, relatively loose regulation |

| Spreads & Commissions | Spot trading fee 0.1%, futures 0.02%-0.04% |

| Pros | Low cost, high liquidity, diverse products |

| Cons | Only supports cryptocurrencies, high regulatory risk |

Applicable Scenario: If Bitcoin breaks above $120,000 in 2025, users can quickly enter and exit the market.

5. TDAmeritrade

TDAmeritrade was established in 1975 in the United States and was acquired by Charles Schwab in 2020. It is a leading platform for US stock trading, suitable for investors focused on US equities.

| Item | Content |

| Business | Stocks, ETFs, options, futures, forex |

| Model | Broker model, focused on zero commission and education |

| Regulation | US SEC, FINRA |

| Spreads & Commissions | Stocks/ETFs zero commission, forex spreads from 1 pip, options $0.65 per contract |

| Pros | Zero commission, powerful thinkorswim tools, rich educational resources |

| Cons | Focuses on US stocks, limited Asian assets |

Applicable Scenario: If investing in Apple Inc. (AAPL) due to new product growth in 2025, users can benefit from zero commission.

3. How to Choose the Most Suitable Platform

Choosing the best online trading platform depends on matching your personal needs with the market environment. Ultima Markets deserves special attention due to its low cost and beginner-friendly features. Detailed considerations are as follows:

- Capital Size and Goals: If you are a beginner with less than 10,000 TWD, selecting a low-threshold, low-cost platform is crucial. Ultima Markets offers a trading account starting from $10, with forex spreads from 0.1 pip, allowing you to participate in the global market with a small capital. For example, if EUR/USD fluctuates due to US data in 2025, you can open a position with $100 and use flexible leverage to capture short-term gains.

- Trading Experience: Beginners often require simple operation and learning support. Ultima Markets’ MetaTrader 4/5 platforms are intuitive and easy to use, combined with a demo account and live analysis, enabling rapid skill improvement. In contrast, other platforms may have complex interfaces or lack educational resources, which are less beginner-friendly.

- Asset Preference: If you want to trade forex, gold, or CFDs, Ultima Markets covers these popular products with low spreads to reduce costs. For example, if gold rises due to geopolitical conflicts in 2025, its gold CFD trading allows efficient participation without high fees.

- Risk Management: Beginners may lose capital due to high leverage. Ultima Markets provides adjustable leverage and stop-loss tools to help control risk. For example, setting each trade’s risk at 1%-2% of your capital protects the principal even during market volatility.

Assuming in 2025 you are monitoring USD/TWD strengthening due to economic recovery, Ultima Markets’ demo account lets you practice strategies, while real-time educational resources help you understand market dynamics. Compared with other platforms, its low cost and support make it more suitable for Taiwanese investors starting out. Whether pursuing short-term gains or learning trading, this platform provides a stable starting point.

4. Practical Tips for Using the Platform

To make the most of the best online trading platforms, practical skills are essential:

- Start with a Demo Account: Test strategies with a demo account, e.g., practice gold CFD trading on Ultima Markets to observe leverage effects.

- Cost Management: Pay attention to spreads and hidden costs. Choosing a low-spread platform (like Ultima Markets) saves expenses.

- Learning Resources: Use technical analysis (e.g., RSI) and live tutorials to improve decision-making.

- Risk Control: Set stop-losses, e.g., limit forex losses to 2% to ensure capital safety.

Example: If the Taiwan stock market rises in 2025, you can test CFDs on Ultima Markets’ demo account and gradually switch to a trading account.

Conclusion: Start Your Online Trading Journey

2025 is a year of online trading growth, and choosing the right platform is key to success. InteractiveBrokers suits advanced users, eToro is great for beginners to copy trades, Binance dominates cryptocurrency, TDAmeritrade focuses on US stocks, while Ultima Markets, with low costs and educational resources, is the ideal starting point for Taiwanese investors. Try a demo account now to experience the best online trading platform and grow your wealth in the market.