On the stage of financial trading, there is an inconspicuous yet ubiquitous element—PIPS. It is the smallest unit of price fluctuation, but it directly determines whether you gain or lose in a trade. Suppose you earn 50 PIPS on the EUR/USD pair, do you know what that means?

It could translate into hundreds of dollars in profit, or represent a key step in risk management. Whether you are a beginner or an experienced trader, PIPS is a core concept you cannot bypass. This article will take you from the basics to fully understand what PIPS is, and reveal how it becomes the invisible driver of trading success. Let’s uncover its mystery together!

What is PIPS? A Basic Explanation

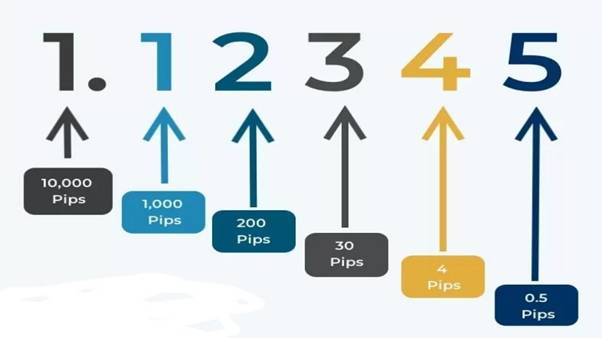

PIPS, short for “Percentage in Point,” is the smallest unit used to measure price movement in financial markets. In forex trading, PIPS are especially important because they capture every change in currency pair prices. For example, when EUR/USD moves from 1.2000 to 1.2001, that is a change of 1 PIP; when USD/JPY moves from 110.00 to 110.01, that is also 1 PIP. It is worth noting that for most currency pairs, a PIP is the fourth decimal place (0.0001), but for yen-related pairs it is the second decimal place (0.01), due to quoting conventions.

For greater precision, some trading platforms also use “Pipette,” which is one-tenth of a PIP. For example, if EUR/USD moves from 1.20005 to 1.20015, that equals a 1 PIP (10 Pipettes) change. Although the concept of PIPS originated in forex, it is not limited to it; in gold, oil, and even cryptocurrency markets, PIPS also serve as a universal standard for measuring price fluctuations. Simply put, PIPS are like the “scale” of the market, helping you capture even the smallest price movements.

How to Use PIPS? Three Key Scenarios in Trading

PIPS are not just numbers; they have real applications in trading. Here are three common scenarios showing how PIPS help traders make decisions.

- Scenario 1: Calculating Profit and Loss

Suppose you buy 1 lot (100,000 units) of EUR/USD at 1.2000, and the price rises to 1.2020, an increase of 20 PIPS. Each PIP is worth about USD 10, so your profit is 20 × 10 = USD 200. PIPS allow you to quickly calculate your earnings, making it simple and intuitive. - Scenario 2: Setting Stop-Loss and Take-Profit

In trading, risk control is crucial. Suppose you go long on USD/JPY at 110.50 and plan to tolerate a maximum loss of 30 PIPS. You can set a stop-loss at 110.20; if the price falls and triggers it, your loss will be 30 × 9.05 (approximate PIP value) = USD 271.5. Similarly, a take-profit can be set at 111.00 (up 50 PIPS), with a potential profit of around USD 452.5. PIPS make risk and reward clear at a glance. - Scenario 3: Evaluating Trading Costs

Each trade requires you to pay the spread (the difference between bid and ask prices), usually measured in PIPS. If the EUR/USD spread is 2 PIPS, trading 1 lot means an entry cost of 2 × 10 = USD 20. For short-term traders, a low spread is crucial as it directly affects net profit.

Through these scenarios, PIPS serve as a quantifiable tool in trading, enabling you to better plan and manage each trade.

The Value of PIPS: Comparative Analysis Across Markets

The definition and value of PIPS vary across markets, and understanding these differences helps you navigate multi-asset trading. Below is a comparison of major markets:

| Asset Type | PIP Definition | Value per PIP (Example) | Volatility Characteristics |

| Forex | For most non-yen pairs, a PIP is defined as the 4th decimal place (0.0001); for yen pairs, it is the 2nd decimal place (0.01) | Example: For EUR/USD, one standard lot (100,000 units) is usually about USD 10 per PIP | Intra-day volatility typically ranges 50–100 PIPs, influenced by economic data and market news |

| Indices | Calculated by whole index points; one point equals a one-unit change in the index price, e.g., 1 point on DAX | Example: For S&P500, one point change equals about USD 50 per PIP (depending on contract size) | Indices are affected by multiple factors; extreme daily moves can exceed 200+ PIPs, reflecting market sentiment |

| Gold | Gold prices usually use USD 0.01/oz as one PIP | Example: For a standard lot (100 oz), each USD 0.01/oz change equals USD 1 per PIP | Gold has medium volatility, driven by geopolitics, inflation expectations, and USD trends |

| Crude Oil | Oil prices usually use USD 0.01/barrel as one PIP | Example: For a 1000-barrel contract, each USD 0.01/barrel change equals USD 10 per PIP | Oil is highly volatile, often swinging due to OPEC decisions, inventory data, and geopolitical events |

| Cryptocurrency | For BTC/USD, a PIP is defined as a USD 1 price change | Example: For BTC/USD, a contract’s USD 1 price change equals USD 1 per PIP | Crypto markets run 24/7 with sharp volatility, easily driven by sentiment and news |

These differences remind us that the value and significance of PIPS must be understood within the context of each specific market for proper application.

Learn to Calculate PIPS in One Minute

Calculating the value of PIPS is not complicated; just a few simple steps are enough. Here’s how:

- Step 1: Identify the PIPS definition

Check the smallest unit of movement for the pair or asset. For example, EUR/USD is 0.0001, USD/JPY is 0.01. - Step 2: Determine the trade size

Trade volume is usually measured in “lots.” 1 lot = 100,000 units, 0.1 lot = 10,000 units. - Step 3: Apply the formula

PIP value = (PIP size × trade size) ÷ current exchange rate.

Example: At USD/JPY 110.50, trading 1 lot, PIP size is 0.01, value = (0.01 × 100,000) ÷ 110.50 ≈ USD 9.05. - Example:

EUR/USD at 1.2000, trading 0.1 lot, PIP size 0.0001, value = (0.0001 × 10,000) ÷ 1.2000 = USD 0.83.

If this feels troublesome, most trading platforms provide built-in calculators—you just enter the data and get the result. Once you master this method, the value of PIPS is no longer a mystery!

>> With trading costs as low as 0.0 pips, low or zero commission, Ultima Markets is favored by investors worldwide. Ultima Markets offers 24-hour two-way trading and a demo account with no deposit required, allowing you to practice trading anytime, anywhere, get familiar with Ultima Markets, and seize opportunities with real-time trading strategies!!

The Pitfalls of PIPS: Common Beginner Misconceptions

Although PIPS may seem simple, beginners often make mistakes. Here are common misconceptions and how to address them:

- Misconception 1: All PIPS have the same value

- Reality: The value of a PIP differs across pairs and markets; for example, EUR/USD and USD/JPY have different PIP values.

- Solution: Always check the PIP definition and calculation for the specific pair before trading.

- Misconception 2: Ignoring the impact of spreads

- Reality: Spreads, measured in PIPS, are hidden costs. For short-term trading, high spreads can consume most of your profits.

- Solution: Choose brokers or trading times with lower spreads, and pay attention to market liquidity.

- Misconception 3: Chasing large PIP counts

- Reality: Chasing swings of hundreds of PIPS may result in excessive risk and neglect solid strategies.

- Solution: Set realistic PIP targets based on your capital and risk tolerance.

Avoid these traps, and you can use PIPS more effectively instead of being led by them.