The market atmosphere in 2025 is full of contradictions: while the global economy is moderately recovering, inflation and interest rate policies still stir investor sentiment.

In this environment, government bonds are back in the spotlight. From stable returns and hedging functions to participating in bond price fluctuations via CFDs, government bonds are no longer exclusive to retirees or conservative investors.

This article will walk you through the basics of government bonds, the significance of yields, risk assessment, and practical trading methods, giving you a comprehensive understanding of government bonds.

What are government bonds CFD and why are they popular?

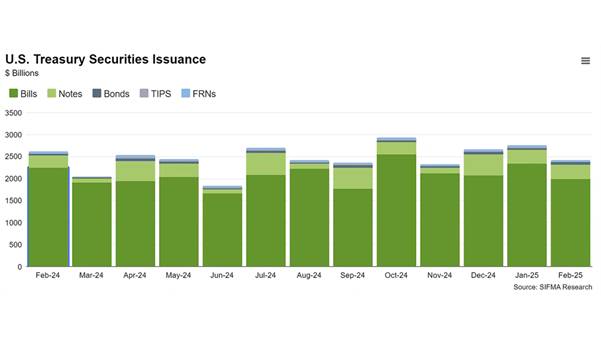

Government bonds are essentially debt securities issued by governments to raise funds. Backed by sovereign credit, they are typically considered one of the lowest-risk investment options.

From short-term treasury bills to medium- and long-term bonds, and even inflation-linked securities, they offer a wide range of choices.

Take the U.S. as an example: the 10-year Treasury yield is a key benchmark in global markets. When the Federal Reserve raises or cuts interest rates, the 10-year yield quickly reflects market expectations, influencing equities, forex, and commodities.

For investors, government bonds not only provide steady coupon payments but also serve as a “barometer” for market trends.

The advantages and hidden risks of government bonds

The main appeal of government bonds lies in their defensive nature.

Stable coupon payments, extremely low default rates, and predictable cash flow make them a “stabilizer” in any portfolio. During significant stock market volatility, bonds often help balance risk.

However, they are not entirely risk-free.

- Interest rate risk: When interest rates rise, the prices of existing bonds naturally decline. The U.S. 10-year yield fluctuating above 4% in 2025 is a prime example.

- Inflation risk: Inflation erodes real returns. If yields fail to outpace inflation, actual returns may be diminished.

- Liquidity differences: Bonds in developed markets like the U.S. and Japan are highly liquid, while those in emerging markets may not be, reducing trading efficiency.

How investing in bonds differs from stocks

Stocks are equity assets with larger price swings and higher potential long-term returns, but also significant volatility.

Bonds, by contrast, are more stable, offering fixed interest and principal repayment, making them ideal as a defensive asset allocation tool.

For example, during periods of slower global growth or heightened risk aversion, capital often flows into government bonds, pushing prices up and yields down. Conversely, when stock markets are booming, the appeal of bonds diminishes.

Yields: The key driver of market trends

Government bond prices and yields move inversely. When yields rise, prices fall, and vice versa.

This dynamic affects not only the bond market but also equities and forex. For example:

- U.S. 10-year yields at 4.29% versus Japan’s 1.62% directly impact the USD/JPY exchange rate.

- Rising yields compress growth stock valuations, while falling yields support the stock market.

For Asian investors, monitoring U.S. and Japanese bond yields often provides early insight into capital flows and shifts in market sentiment.

How to invest in bonds: Traditional methods vs. CFDs

Traditional method

You can purchase physical bonds through banks or brokers and hold them to maturity to receive coupon payments.

While stable, this method requires higher capital and offers less flexibility due to liquidity constraints.

Bond CFD (Contract for Difference) method

If you want more flexibility in trading government bonds, CFDs are a practical option. Platforms like Ultima Markets let you trade with low margin requirements and use

Key advantages include:

- No need to own the bond to profit from price movements.

- Ability to go long or short, enabling two-way trading flexibility.

- Use stop-loss and take-profit orders to manage risk flexibly.

For example, if you expect U.S. Treasuries to rise due to rate cuts, you can go long on bond CFDs. Conversely, if you anticipate rising yields pushing prices down, you can short them for potential gains.

Why trade bond CFDs with Ultima Markets?

Trading government bonds on a safe and regulated platform ensures fund protection, transparent execution, and access to professional tools to reduce risks and improve efficiency.

Ultima Markets offers:

- Low costs: Tight spreads and transparent commissions for clear and controllable costs.

- Leverage: Adjust leverage according to your risk tolerance to maximize capital efficiency.

- Professional tools: Access yield curves, macroeconomic calendars, and Trading Central analysis to guide market decisions.

- Cross-asset portfolio: Manage over 250 CFDs, including bonds, forex, gold, and indices, in one account to build a diversified portfolio.

Remember to start with a demo account to practice before live trading.

Conclusion

In 2025, opportunities and uncertainties coexist. Government bonds are not only the defensive core of a portfolio but also a critical indicator of economic and market trends.

By building stable cash flows with bonds and enhancing flexibility through CFDs, investors can better navigate market challenges.

To get started, consider testing the waters with small, phased positions before scaling up. This way, government bonds can serve as both a stabilizer and a flexible component in your portfolio.